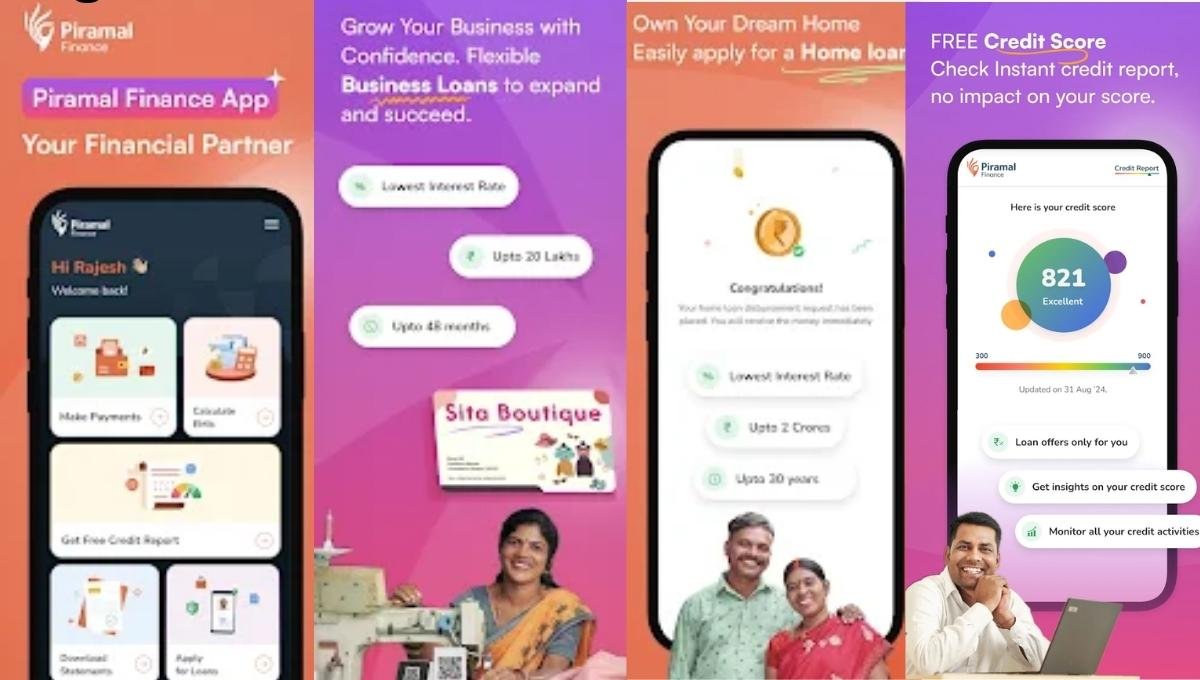

In today’s fast-paced world, financial needs arise unexpectedly. Whether it’s buying a home, funding a wedding, or growing your business, access to reliable financial solutions is crucial. Piramal Finance – Loans & More is a trusted app that simplifies the loan application process with its seamless digital interface. Offering a variety of loan options, EMI calculators, free credit score checks, and more, this app is designed to meet your financial needs quickly and efficiently.

Why Choose Piramal Finance?

Piramal Finance is a registered Housing Finance Company (HFC) with the Reserve Bank of India (RBI). The platform offers a wide range of financial products, including Home Loans, Personal Loans, Business Loans, and Used Car Loans. The app is 100% digital, secure, and user-friendly, making it an excellent choice for individuals and businesses seeking quick financial solutions.

Key Features:

- Quick and hassle-free loan approvals

- Minimal documentation requirements

- Flexible repayment options

- Secure transactions and data privacy

- Free credit score checks

- Useful financial tools like EMI & Eligibility Calculators

- 24/7 customer support

With Piramal Finance, users can experience a smooth and efficient loan process tailored to their specific financial goals.

Types of Loans Available

1. Home Loan

Owning a home is a major milestone, and Piramal Finance helps make it a reality with its flexible and affordable home loans.

Features:

✔ Loan amount: ₹5 Lakh – ₹2 Crore ✔ Tenure: Up to 30 years ✔ Interest rates starting at 9.50% p.a.

Benefits:

✔ Tax benefits on home loans ✔ Flexible repayment options ✔ 100% digital documentation ✔ Secure and transparent process

2. Personal Loan

For urgent financial needs like medical emergencies, weddings, or travel, an Instant Personal Loan from Piramal Finance provides a reliable solution.

Features:

✔ Loan amount: ₹25,000 – ₹5 Lakh ✔ Tenure: 9 to 60 months ✔ Interest rates starting at 12.99% p.a. ✔ Minimum monthly salary: ₹25,000

Benefits:

✔ Instant disbursal ✔ No co-signer or guarantor required ✔ 100% digital documentation ✔ Secure and fast processing

Example:

- Loan Amount: ₹1,00,000

- Tenure: 12 months

- Interest Rate: 14.49%

- Processing Fee: ₹1,500

- EMI: ₹9,002

- Total Repayment Amount: ₹1,09,701

3. Business Loan

For entrepreneurs and small businesses, Piramal Finance offers both secured and unsecured business loans.

Secured Business Loan:

✔ Loan amount: Up to ₹2 Crore ✔ Tenure: Up to 15 years ✔ Interest rate: Starting at 11.50% p.a.

Unsecured Business Loan:

✔ Loan amount: Up to ₹20 Lakh ✔ Tenure: Up to 48 months ✔ Interest rate: Starting at 16.49% p.a.

Benefits:

✔ No collateral required for unsecured loans ✔ Instant fund disbursal ✔ 100% digital documentation ✔ Secure transactions

4. Financial Tools & Additional Services

Check Your Free Credit Score

Piramal Finance offers free credit score checks, helping you monitor your financial health and improve your eligibility for loans.

Loan Eligibility & EMI Calculators

Plan your finances effectively using the app’s built-in Loan Eligibility Calculator and EMI Calculator.

Fraud Shield Plan

For just ₹499, users can avail protection against card fraud, UPI fraud, and identity theft with coverage up to ₹25,000.

How to Apply for a Loan?

Applying for a loan with Piramal Finance is simple and takes just a few steps:

- Download the Piramal Finance App from the Google Play Store.

- Register & Log In using your mobile number.

- Choose the type of loan you wish to apply for.

- Fill in your details (personal, employment, and financial information).

- Upload digital documents (ID proof, address proof, and income proof).

- Select loan amount and tenure.

- Submit the application and receive instant approval.

- Get funds disbursed to your bank account within minutes!

Download the Piramal Finance App Today!

Ready to take charge of your finances? Download the Piramal Finance App now and apply for instant loans with ease.

Also read: Binance: Buy Bitcoin & Crypto – The Ultimate Crypto Trading App